Do bank regulations matter for financial stability? Evidence from a developing economy | Emerald Insight

JRFM | Free Full-Text | A Holistic Perspective on Bank Performance Using Regulation, Profitability, and Risk-Taking with a View on Ownership Concentration | HTML

Machine learning shows that the Covid-19 pandemic is impacting U.S. public companies unequally by changing risk structures | PLOS ONE

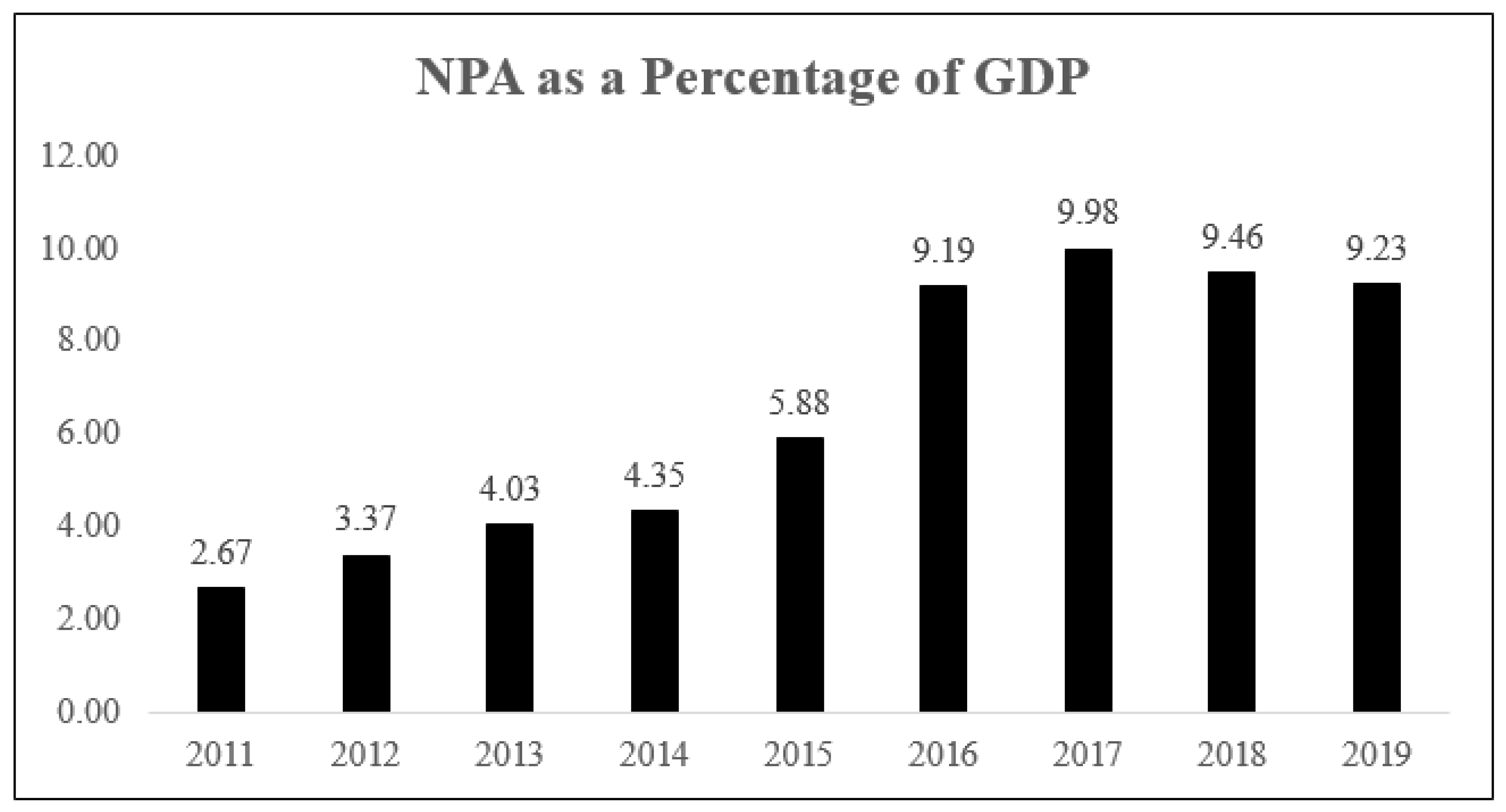

Impacts of risk and competition on the profitability of banks: Empirical evidence from Pakistan | PLOS ONE

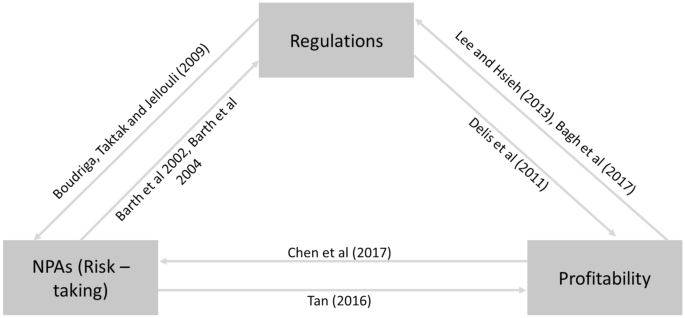

A literature review of risk, regulation, and profitability of banks using a scientometric study | Future Business Journal | Full Text

On the income diversification and bank market power nexus in the MENA countries: Evidence from a GMM panel-VAR approach - ScienceDirect

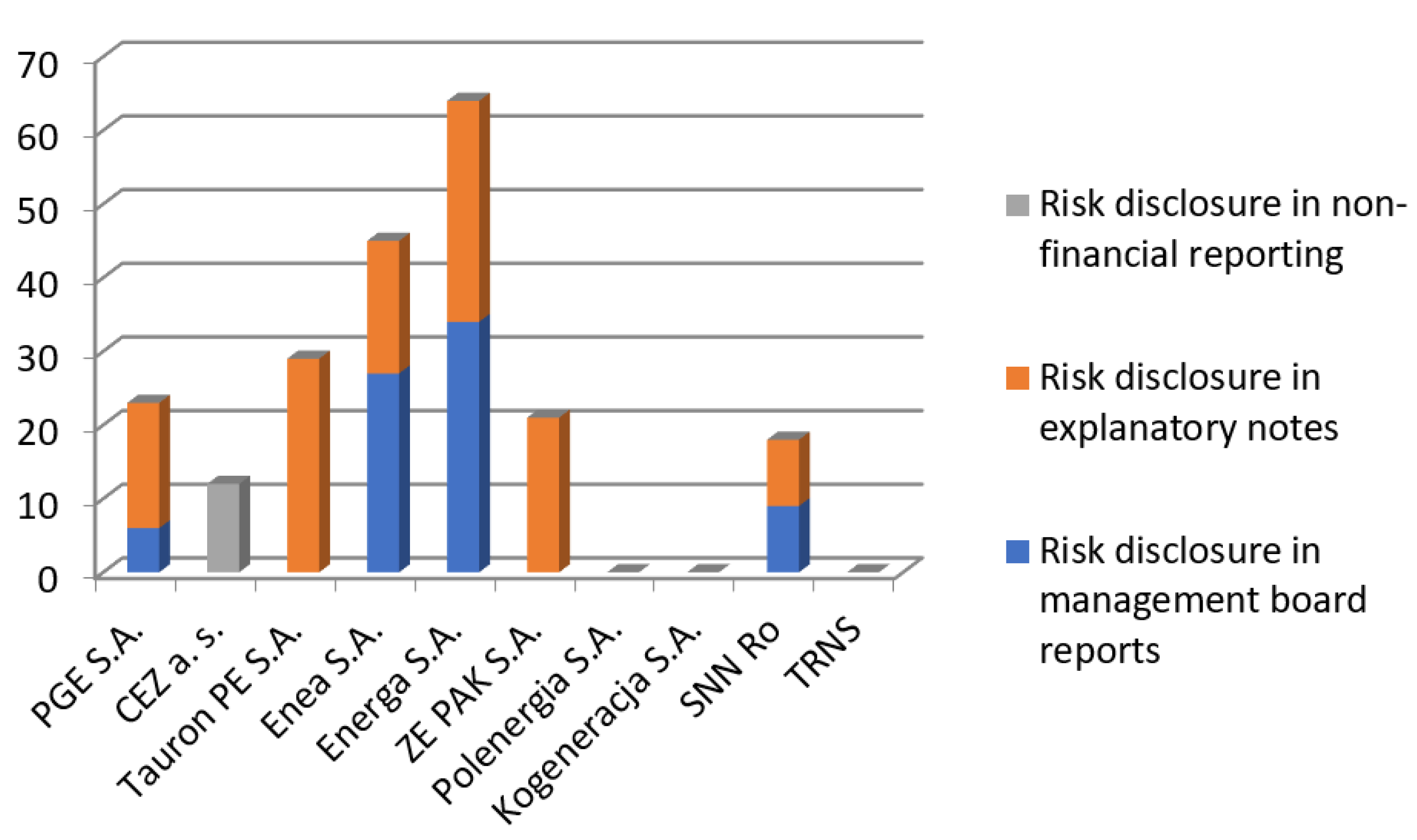

Energies | Free Full-Text | Corporate COVID-19-Related Risk Disclosure in the Electricity Sector: Evidence of Public Companies from Central and Eastern Europe | HTML

Machine learning shows that the Covid-19 pandemic is impacting U.S. public companies unequally by changing risk structures | PLOS ONE

Full article: Banking diversity, financial complexity and resilience to financial shocks: evidence from Italian provinces

Do bank regulations matter for financial stability? Evidence from a developing economy | Emerald Insight

Machine learning shows that the Covid-19 pandemic is impacting U.S. public companies unequally by changing risk structures | PLOS ONE

Z-score, 2002–2008. This figure shows the average Z-score for banks... | Download Scientific Diagram

Market power and stability of financial institutions: evidence from the Italian banking sector | Emerald Insight

Debt‐to‐GDP changes and the great recession: European Periphery versus European Core - Agoraki - International Journal of Finance & Economics - Wiley Online Library